- The Reserve Bank of India (RBI) announces the availability of reversal of liquidity facilities under Standing Deposit Facility (SDF) and Marginal Standing Facility (MSF) on an overnight basis, including Sundays and holidays, effective from December 30.

- Reversal under SDF and MSF is allowed only on the next working day in Mumbai.

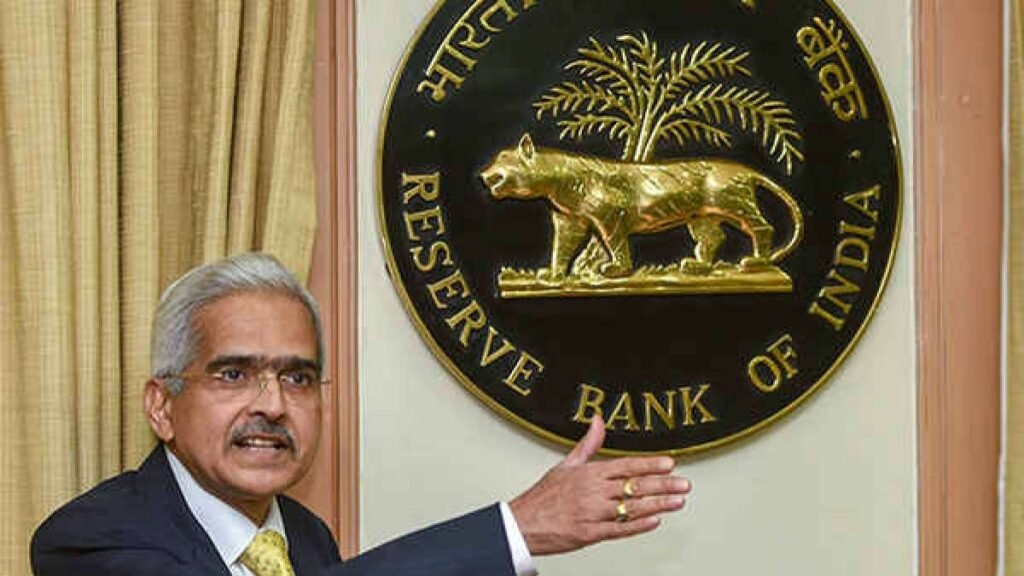

- RBI Governor Shaktikant Das had previously announced the SDF and MSF reversal facility to remain open on all days for deploying and using tools to manage liquidity in case of elevated inflation.

- The SDF/MSF bids triggered under the Automated Sweep-In and Sweep-Out (ASISO) facility will reverse on the next calendar day.

- Manual bids placed through the e-Kuber portal allow eligible entities to choose the tenor at the time of placing the bid.

- Access to SDF/MSF will be available on all days, including Sundays and holidays.

- RBI is using the Standing Deposit Facility (SDF) as an additional tool to absorb liquidity and control inflation.

- The use of SDF enables RBI to take deposits from commercial banks without compensating them with government securities.

Q: Why RBIis using the Standing Deposit Facility (SDF) ?

- A. To encourage commercial banks to invest in government securities

- B. To absorb liquidity and control inflation

- C. To compensate commercial banks with government securities

- D. To facilitate faster fund transfers between banks.

Ans : B. To absorb liquidity and control inflation