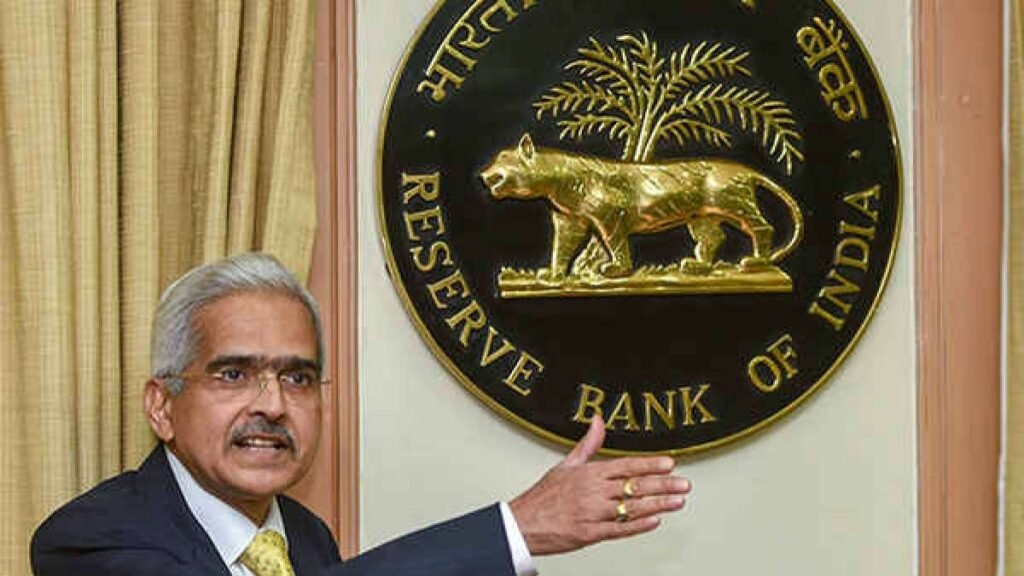

RBI Keeps Repo Rate Unchanged at 5.25%, Maintains Neutral Policy Stance

On 6 February 2026, Reserve Bank of India (RBI) Governor Sanjay Malhotra announced that the Monetary Policy Committee (MPC) unanimously decided to keep the policy repo rate unchanged at 5.25%, while maintaining a neutral policy stance.

| Policy Instrument | Current Rate | Decision | Notes |

|---|---|---|---|

| Repo Rate | 5.25% | Unchanged | Reflects cautious stance amid global uncertainties. |

| Standing Deposit Facility (SDF) | 5.00% | Unchanged | Maintains liquidity balance. |

| Marginal Standing Facility (MSF) & Bank Rate | 5.50% | Unchanged | No change to borrowing costs for banks. |

| Monetary Policy Stance | Neutral | Continued | MPC remains flexible to respond to evolving conditions. |

📊 Economic Outlook

- Inflation: Currently low and under control, allowing RBI to avoid tightening.

- Growth Projection: FY26 GDP growth estimated at 7.4%, supported by strong domestic demand.

- Global Context: MPC highlighted uncertainties in global markets but noted India’s resilience.

- Past Actions: Since Feb 2025, RBI has already cut repo rate by 125 basis points, creating room for growth.