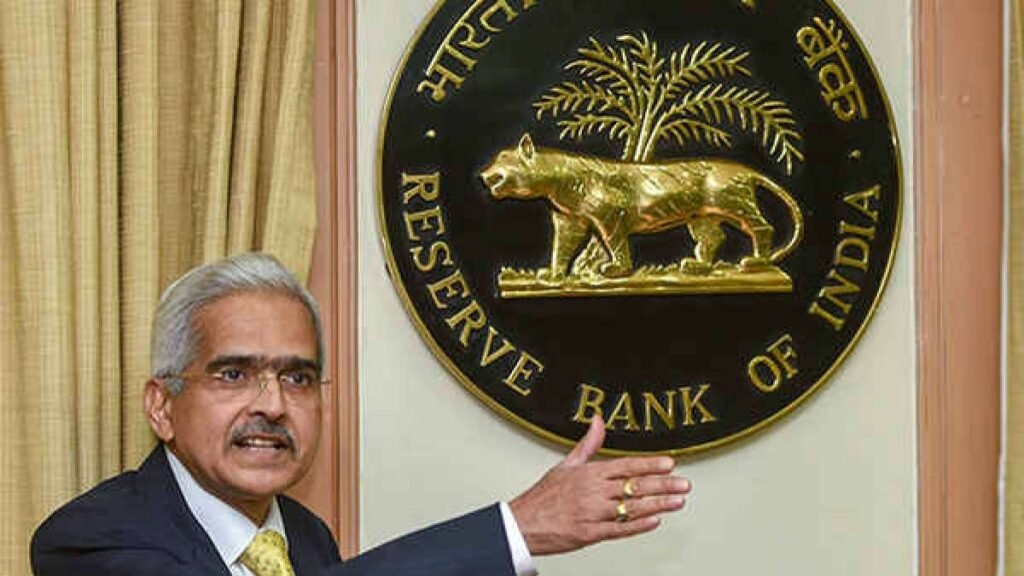

- The Reserve Bank of India (RBI) has maintained the repo rate at 6.5 percent for the sixth consecutive time.

- The decision was made by a 5:1 majority vote of the six-member monetary policy committee (MPC) due to retail inflation persisting above the 4 percent target.

- The repo rate is the interest rate at which banks borrow funds from the RBI to address short-term liquidity gaps.

- Other key interest rates include the Standing Deposit Facility rate at 6.25 percent, Marginal Standing Facility (MSF) rate at 6.75 percent, and the Bank Rate at 6.75 percent.

- RBI Governor Shaktikanta Das projected retail inflation based on the Consumer Price Index (CPI) at 5.4 percent for the current fiscal year and 4.5 percent for the next financial year.

Q: What is the primary purpose of the repo rate?

A) To regulate the money supply in the market and combat price inflation.

B) To determine the operating bank rates.

C) To enhance the availability of funds for banks.

D) To stimulate consumer demand.

Answer: A) To regulate the money supply in the market and combat price inflation