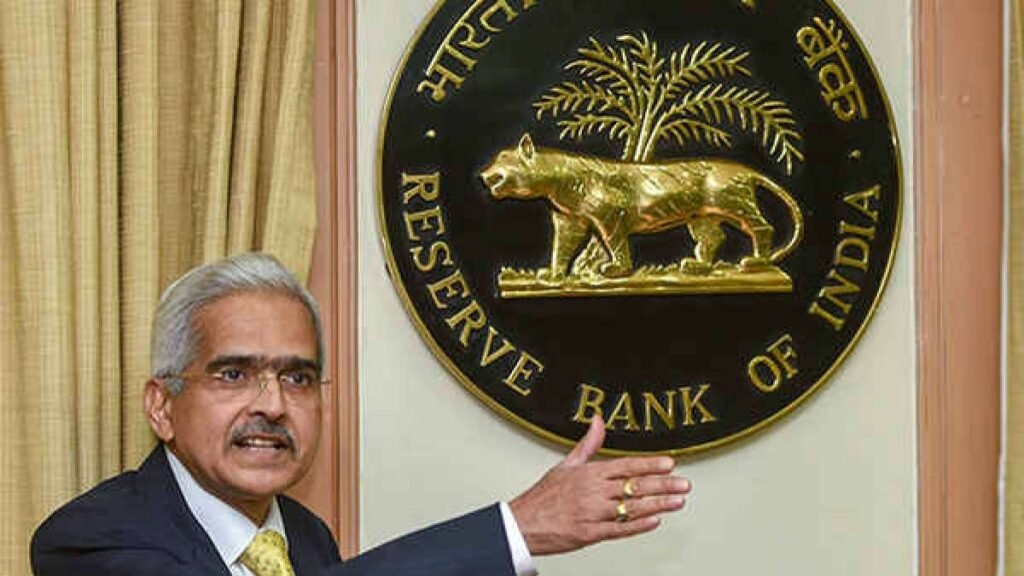

The Reserve Bank of India’s Monetary Policy Committee (MPC) maintained the key repo rate at 6.5 per cent for the seventh consecutive meeting on April 5, 2024.

- The focus was on controlling retail inflation, which has remained above the 4 per cent target.

- The repo rate is the rate at which banks borrow funds from the RBI to address short-term liquidity gaps.

- The majority decision was 5:1 to keep the interest rate unchanged, with the Standing Deposit Facility rate at 6.25 per cent and the Marginal Standing Facility (MSF) rate and Bank Rate at 6.75 per cent.

- The MPC retained the stance of ‘withdrawal of accommodation’ with a majority of five votes.

- The MPC consists of six members, including three from RBI, including Governor Shaktikanta Das, and three appointed by the central government.

- The three-day review meeting of the MPC, which began on April 2, concluded on April 5, 2024.

Q: What decision did the Reserve Bank of India’s Monetary Policy Committee (MPC) make regarding the repo rate on April 5, 2024?

a) Increased it

b) Decreased it

c) Maintained it

d) Abolished it

Ans : c) Maintained it

Q: What is the repo rate?

a) The rate at which banks lend funds to the RBI

b) The rate at which RBI borrows funds from banks

c) The rate at which banks borrow funds from the RBI

d) The rate at which RBI lends funds to the government

Ans : c) The rate at which banks borrow funds from the RBI