The Reserve Bank of India (RBI), in its December monetary policy meeting, decided by a 4:2 majority to keep the policy repo rate unchanged at 6.50% for the 11th consecutive time since February 2023. The SDF rate remains at 6.25%, and the MSF rate and Bank Rate at 6.75%. The RBI also reduced the Cash Reserve Ratio (CRR) by 50 basis points to 4%, releasing ₹1.16 lakh crore to ease liquidity stress.

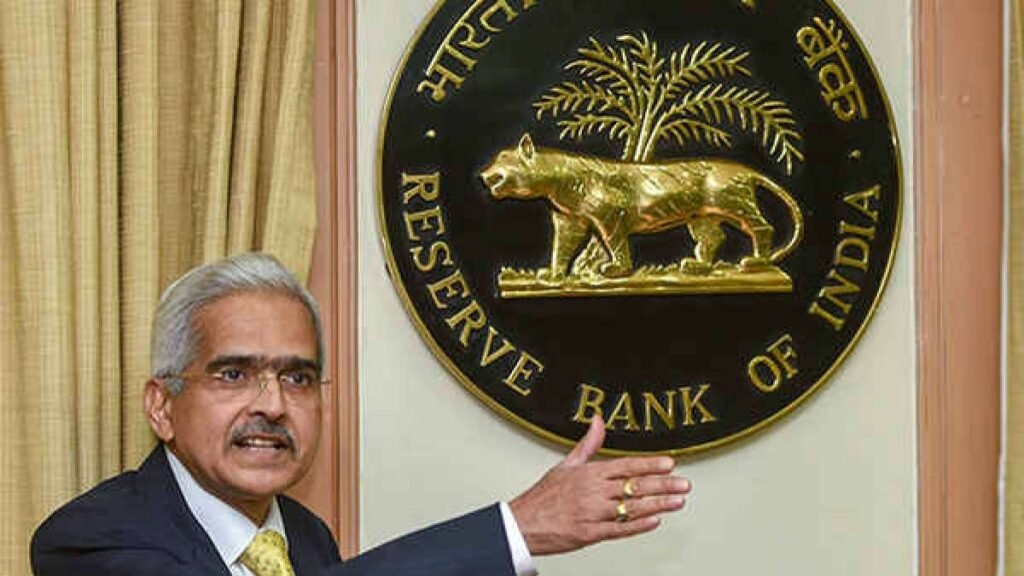

RBI Governor Shaktikanta Das emphasized the commitment to price stability amid inflationary pressures and revised the FY25 inflation forecast to 4.8% from 4.5%. The MPC retained its neutral stance, focusing on aligning inflation with the target while supporting growth. The policy meeting was held on December 4-6, 2024.