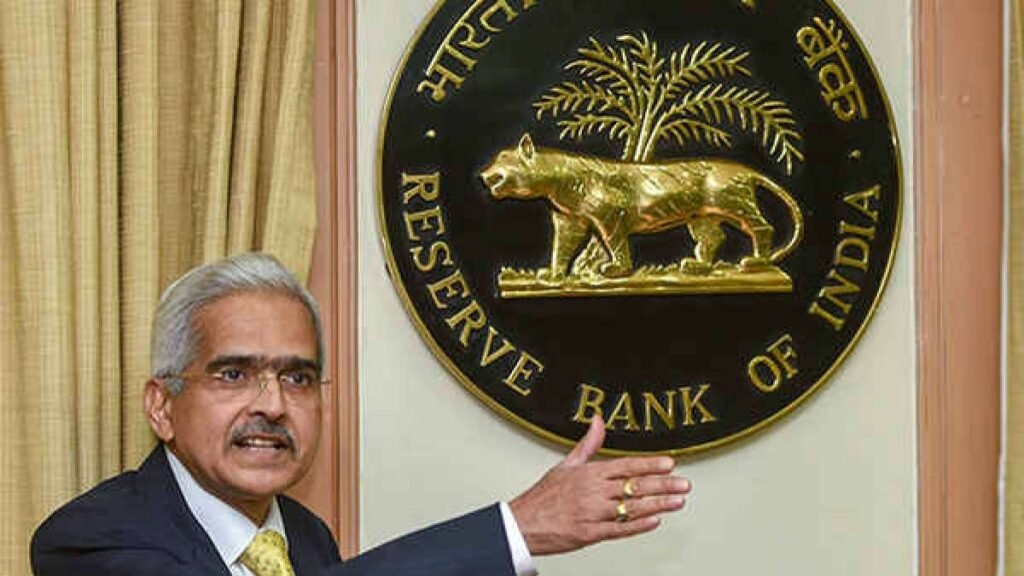

Reserve Bank of India (RBI) to launch interoperable payment system for internet banking in 2024.

- System will be implemented by NPCI Bharat BillPay and aims to facilitate quicker settlement of funds for merchants.

- This addresses delays and settlement risks for merchants using payment aggregators for internet banking transactions.

- India accounts for nearly 46% of global digital transactions and UPI is the leading payment system with close to 80% share.

- UPI transactions have grown significantly and new user registrations are increasing.

- RBI emphasizes trust in digital payments is built on transparency, ease of use, and security and promotes awareness programs.

Q. Which organization will be responsible for implementing the new interoperable payment system?

a) Reserve Bank of India (RBI)

b) National Payments Corporation of India (NPCI)

c) NPCI Bharat BillPay Limited (Correct)

d) Payment Aggregators (PAs)

Ans : b) National Payments Corporation of India (NPCI)