Q. Who won the Indian Super League (ISL) 2024-25 title?

A) Bengaluru FC

B) Mumbai City FC

C) Mohun Bagan Super Giant

D) Kerala Blasters

Show Answer

✅ Correct Answer: C) Mohun Bagan Super Giant

Mohun Bagan Super Giant won the 2024-25 Indian Super League (ISL) title with a 2-1 victory over Bengaluru FC on April 12, 2025, at Vivekananda Yuba Bharati Krirangan Stadium, Kolkata.

Q. Who won the gold medal in the compound mixed team event at Archery World Cup Stage 1, 2025?

A) Huang I-Jou and Chen Chieh-Lun

B) Deepika Kumari and Atanu Das

C) Jyothi Surekha Vennam and Rishabh Yadav

D) Abhishek Verma and Jyothi Surekha Vennam

Show Answer

Answer: C) Jyothi Surekha Vennam and Rishabh Yadav

The Indian archery duo of Jyothi Surekha Vennam and Rishabh Yadav won the gold medal in the compound mixed team event at the Archery World Cup Stage 1 in Florida, USA, on April 12, 2025.

Q. Who has been reappointed as the chairperson of the ICC Men’s Cricket Committee in April 2025?

A. Anil Kumble

B. Jonathan Trott

C. Sourav Ganguly

D. VVS Laxman

Show Answer

Answer: C. Sourav Ganguly

Sourav Ganguly, former Indian cricket captain, has been reappointed as the chairperson of the ICC Men’s Cricket Committee as of April 13, 2025.

Q. What is the full form of AIKEYME?

A. Africa India Key Economic Maritime Engagement

B. Africa India Knowledge Exchange for Maritime Excellence

C. Africa India Key Maritime Engagement

D. African-Indian Kinetic Maritime Exercise

Show Answer

Answer: C. Africa India Key Maritime Engagement

Africa India Key Maritime Engagement (AIKEYME), a multilateral maritime exercise, began on 13 April 2025 in Tanzania and will conclude on 18 April 2025.

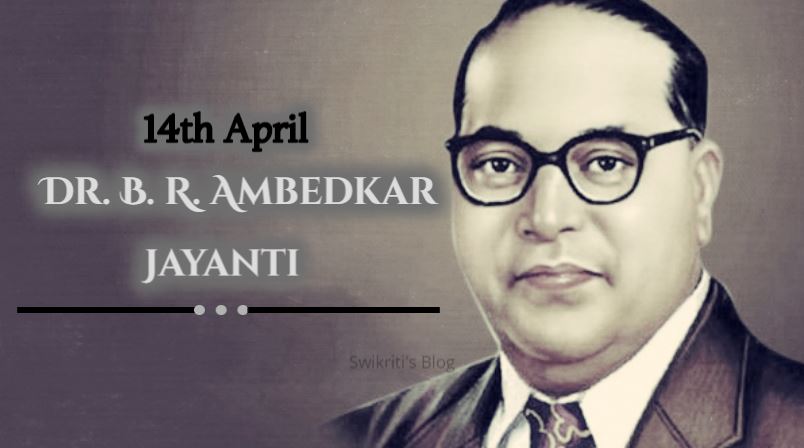

Q. What major role did Dr. Ambedkar play in Indian history?

A. First President of India

B. Founder of the Supreme Court

C. Chief architect of the Indian Constitution

D. First Nobel Laureate from India

Show Answer

Answer: C. Chief architect of the Indian Constitution

Dr. Bhimrao Ramji Ambedkar, fondly called Babasaheb, is being honored across India on his 134th birth anniversary. Born on April 14, 1891, Ambedkar was the chief architect of the Indian Constitution and a champion of social justice.

Q. What type of weapon system did India successfully demonstrate in April 2025, capable of shooting down fixed-wing aircraft, missiles, and swarm drones?

A. Ballistic missile

B. Hypersonic missile

C. Laser-based weapon system

D. Anti-tank missile

Show Answer

Answer: C. Laser-based weapon system

For the first time, India has successfully demonstrated a 30-kilowatt laser-based weapon system, capable of shooting down fixed-wing aircraft, missiles, and swarm drones.