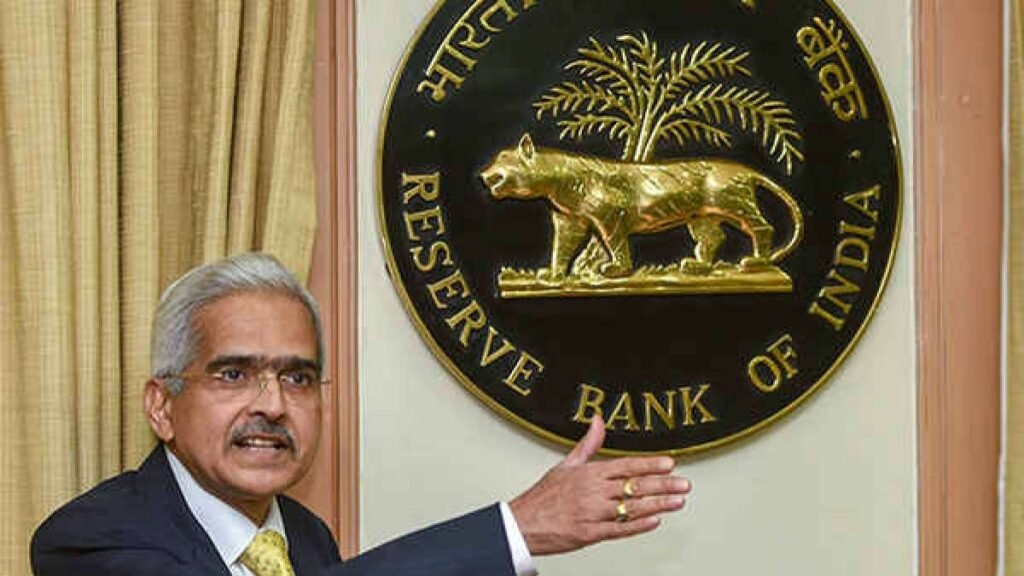

India’s foreign exchange reserves reached a record high, crossing the USD 700 billion mark for the first time. As of September 27, 2024, the reserves surged by USD 12.588 billion to USD 704.885 billion, according to the Reserve Bank of India (RBI). This is a significant increase from the previous high of USD 692.296 billion, offering a robust economic buffer against global financial uncertainties.

The largest part of the reserves, Foreign Currency Assets (FCA), stood at USD 616.154 billion, with the country’s gold reserves valued at USD 65.796 billion. These reserves now cover more than a year’s worth of projected imports, showcasing India’s economic resilience. In 2023, India added around USD 58 billion to its reserves, contrasting with the USD 71 billion decline in 2022.

Foreign exchange reserves, held in currencies like the US Dollar, Euro, Yen, and Pound, are vital for managing currency volatility. The RBI has been managing the rupee’s stability by buying dollars when the rupee strengthens and selling when it weakens, making the rupee one of Asia’s most stable currencies. This stability enhances the attractiveness of Indian assets to international investors.