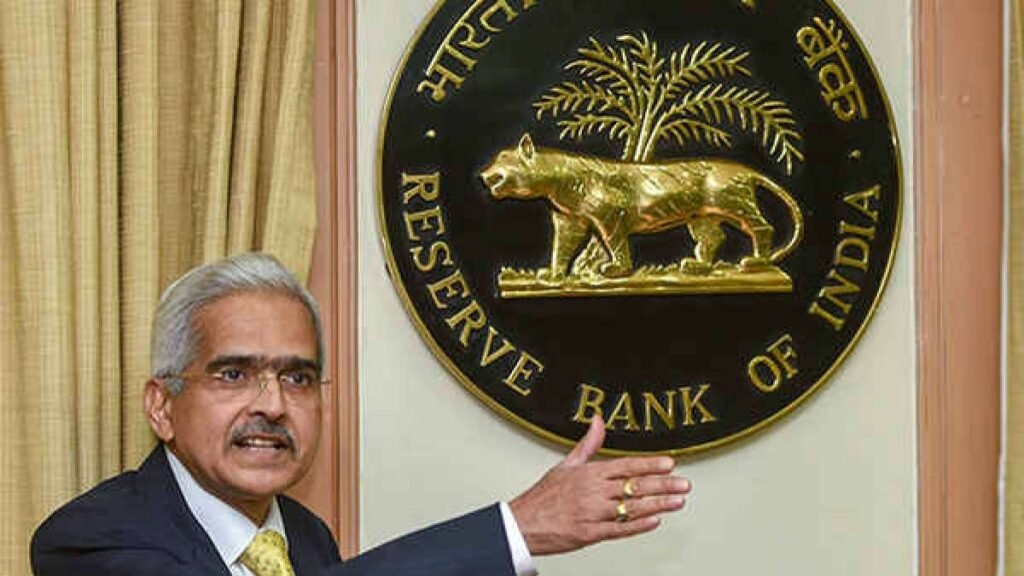

The Reserve Bank of India (RBI) will gradually reduce its requirement for banks to park an additional 10% of their fresh deposits with the central bank. The reduction of this requirement, known as the incremental cash reserve ratio (ICRR), will occur in stages.

- Starting on 9 September 2023, 25% of the ICRR will be released.

- Another 25% will be released on 23 September.

- The remaining 50% of the ICRR will be released on 7 October.

- The ICRR was initially introduced to address a surge in liquidity resulting from the return of 90% of ₹2,000 notes into the banking system.

- The RBI aims to release the ICRR gradually to prevent sudden shocks to system liquidity and to maintain orderly money market functioning.

- RBI Governor Shaktikanta Das had mentioned that withdrawing the ICRR could remove approximately ₹1 trillion in liquidity from the banking system.

- The current surplus liquidity in the system is ₹76,000 crore, which is lower than the earlier surplus of ₹3.5 trillion.

- The RBI’s objective is to control liquidity to prevent excess liquidity from contributing to inflation, aiming to keep system liquidity at around ₹1 trillion.

- The reduction in ICRR is designed not to significantly impact system liquidity, with other factors like currency in circulation and forex intervention compensating for the incremental money from the ICRR reduction.

Q.: What is the primary reason for the Reserve Bank of India (RBI) gradually reducing the incremental cash reserve ratio (ICRR) requirement for banks?

A) To encourage banks to deposit more funds with RBI.

B) To address a shortage of liquidity in the banking system.

C) To prevent excess liquidity from contributing to inflation.

D) To generate more revenue for the central bank.

Answer: C) To prevent excess liquidity from contributing to inflation.