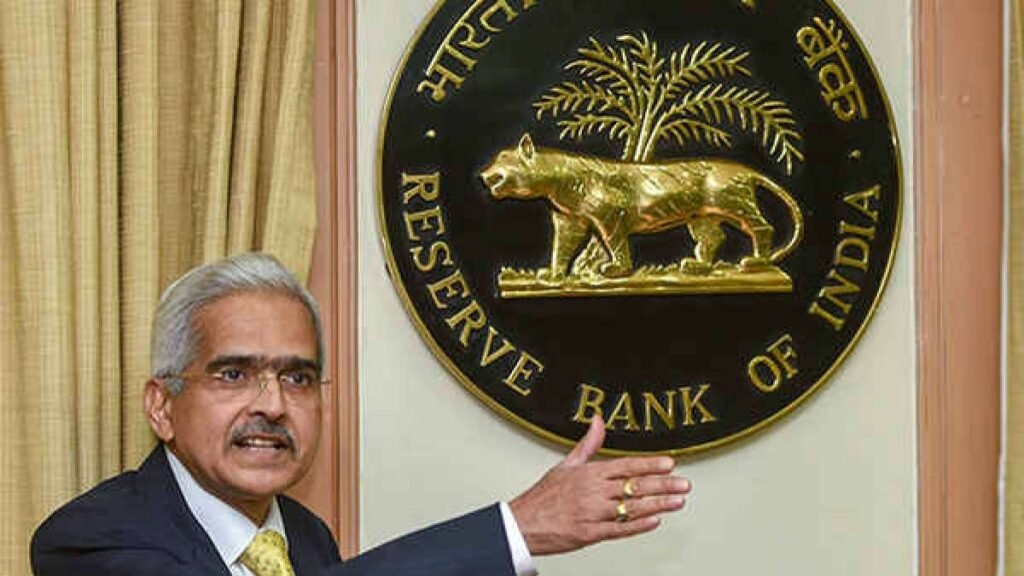

The RBI Governor, Shaktikanta Das, announced on October 6, 2023, that the monetary policy committee (MPC) has unanimously decided to maintain the policy repo rate at 6.50 percent.

- The MPC meeting took place from October 4 to October 6, 2023, and this decision marks the fourth consecutive time the repo rate has remained unchanged.

- The standing deposit facility (SDF) rate remains at 6.25 percent, while the marginal standing facility (MSF) rate and the Bank Rate remain at 6.75 percent.

- The MPC, with a majority vote of 5 out of 6 members, focuses on withdrawing accommodation to align inflation with the target while supporting economic growth.

- Headline inflation experienced a surge in July, primarily due to tomato and vegetable prices, but corrected somewhat in August and is expected to ease further in September.

- Core inflation (CPI excluding food and fuel) is declining.

- The overall inflation outlook is uncertain due to factors such as reduced kharif sowing for key crops, low reservoir levels, and volatile global food and energy prices.

- The projected real GDP growth for 2023-24 is 6.5 percent, with specific growth rates for each quarter mentioned.

- The MPC remains vigilant and ready to take necessary policy measures to align inflation with the target and anchor inflation expectations.

MCQs

Q.: What was the decision of the Monetary Policy Committee (MPC) regarding the policy repo rate on October 6, 2023?

a) Increased it by 0.25 percent

b) Decreased it by 0.25 percent

c) Maintained it at 6.50 percent

d) Maintained it at 7.00 percent

Ans : c) Maintained it at 6.50 percent

Q.: What is the projected real GDP growth by RBI Monetary Policy Committee for Q1:2024-25 ?

a) 5.7 percent b) 6.0 percent c) 6.5 percent d) 6.6 percent

Ans : c) 6.5 percent